The total U.S. federal debt, at $14.2 trillion, is approaching the amount of our annual Gross Domestic Product (GDP) of $14.6 trillion. The chart below, from the non-partisan Center on Budget and Policy Priorities, shows the major components of the debt as a percent of GDP. It indicates that the bulk of the deficit is due to the Bush tax cuts and the unfunded wars in Iraq and Afghanistan, combined more recently with the loss of revenue from the Great Recession and the investments in economic recovery.

The Great Recession cost us a whole lot of tax revenue and increased spending for unemployment insurance.

Nobel Prize-winning economist and N.Y. Times columnist Paul Krugman's analysis of income and spending from 2007 to 2010 shows that we have more of a revenue problem than, as Republicans assert, a spending problem.

Even at 100% of GDP, this is not a record high debt (as shown by the chart below), and it looks like we can continue to borrow at very low rates for some time. In fact, even though S&P strangeley warned on April 18, 2011, that it might lower its future rating of U.S. debt, it should be noted that the price of 10-year Treasury Notes actually rose on that day, resulting in a corresponding decrease in interest rates. And by Thursday, April 21st, the S&P 500 Stock Index had risen 1.3% for the week.

For perspective, the chart below shows the history of the the national debt as a percent of GDP, going back to just before World War II:

Yes, the debt needs to be reduced, and we will be much more successful at doing so if we follow a "balanced" approach along the lines proposed by President Obama. The key here is to keep federal spending going strong in the short term to promote continued economic growth and job creation. Economic growth, by itself, will lower the debt both in absolute terms and also relative to GDP. Levying additional taxes, particularly on the wealthy, will provide additional debt reduction in the short term, without harming the economic recovery.

Here is a Fact Sheet on PresidentObama's fiscal plan for 2012 and beyond.

Republican "Deficit Reduction" Plan

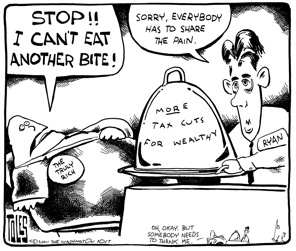

If we follow the Republican plan, adopted by the U.S. House Republicans on April 15, 2011, we will actually increase the debt.

On the face of it, the official Republican budget plan, is not really about reducing the national debt. Instead, it appears to be another chapter of "starve the beast" conservative ideology to shrink government and eliminate it as a meaningful protective mechanism in our lives.

it appears to be another chapter of "starve the beast" conservative ideology to shrink government and eliminate it as a meaningful protective mechanism in our lives.

Despite slashing spending more than the Obama plan, this budget still results in budget deficits for the next 28 years! The federal debt would grow year by year until 2040. That's right. It is not until 2040 that the Republican plan achieves a balanced budget. Only then, does it begin to bring down the national debt. How can a plan that cuts more spending produce more deficits? The Republican plan takes so long to achieve a balanced budget because the plan includes an additional $2.9 trillion in tax cuts for corporations and the wealthy over the next ten years.

...The House budget proposal that was unveiled last week — and was praised as “bold” and “serious” by all of Washington’s Very Serious People — includes savage cuts in Medicaid and other programs that help the neediest, which would among other things deprive 34 million Americans of health insurance. It includes a plan to privatize and de-fund Medicare that would leave many if not most seniors unable to afford health care. And it includes a plan to sharply cut taxes on corporations and to bring the tax rate on high earners down to its lowest level since 1931. The nonpartisan Tax Policy Center puts the revenue loss from these tax cuts at $2.9 trillion over the next decade.

David Brooks, Republican columnist for the New York Times, commented on the Ryan/Republican budget on April 8, 2011, and basically acknowledged that it is not a real plan:

As presently configured, it is unacceptable to moderate voters and stands no chance of passage. Substantively, it does not address the structural problems plaguing the American economy: wage stagnation, inequality, declining growth rates. It doesn’t have an answer to rising health care costs. Nor does it leave room for future policy creativity; there’s no money to allow future generations to rise to unforeseen challenges.

Yes, Republicans are calling the debt a “catastrophe” and are demanding immediate, drastic federal spending cuts. But this demand has a totally hollow ring to it. It's more of the same strategy that brought us the two major tax cuts under the Bush Administration and caused a doubling of federal debt from $4 trillion to $8 trillionm, yet brought not a peep from Republicans about deficits. Instead, our U.S. Representative, Greg Walden (R-OR2), proudly accepted a “Hero of the Tax Payer” award from Americans for Tax Reform, which has strangulation of the U.S. government as its goal, and induces most Republican political candidates to sign a pledge not to raise any taxes. Along this line, Rep. Walden, on April 8, 2011, said:

One thing is clear: We don’t have deficits because Americans are taxed too little; we have deficits because Washington spends too much. We have got to stop spending money we don't have.

But somebody's got the money. As

Michael Moore reminds us: "America is not broke! ...This country is awash in wealth and cash."

It's time to use that wealth and cash, our common wealth, for the common good.